Banking and Finance Guides You Can Use Right Now

Whether you’re a student, a retiree, or a busy professional, handling money can feel overwhelming. The good news? Most banking tasks only need a few clear steps. Below you’ll find straight‑forward advice you can put into action today.

Master Common Banking Tasks Quickly

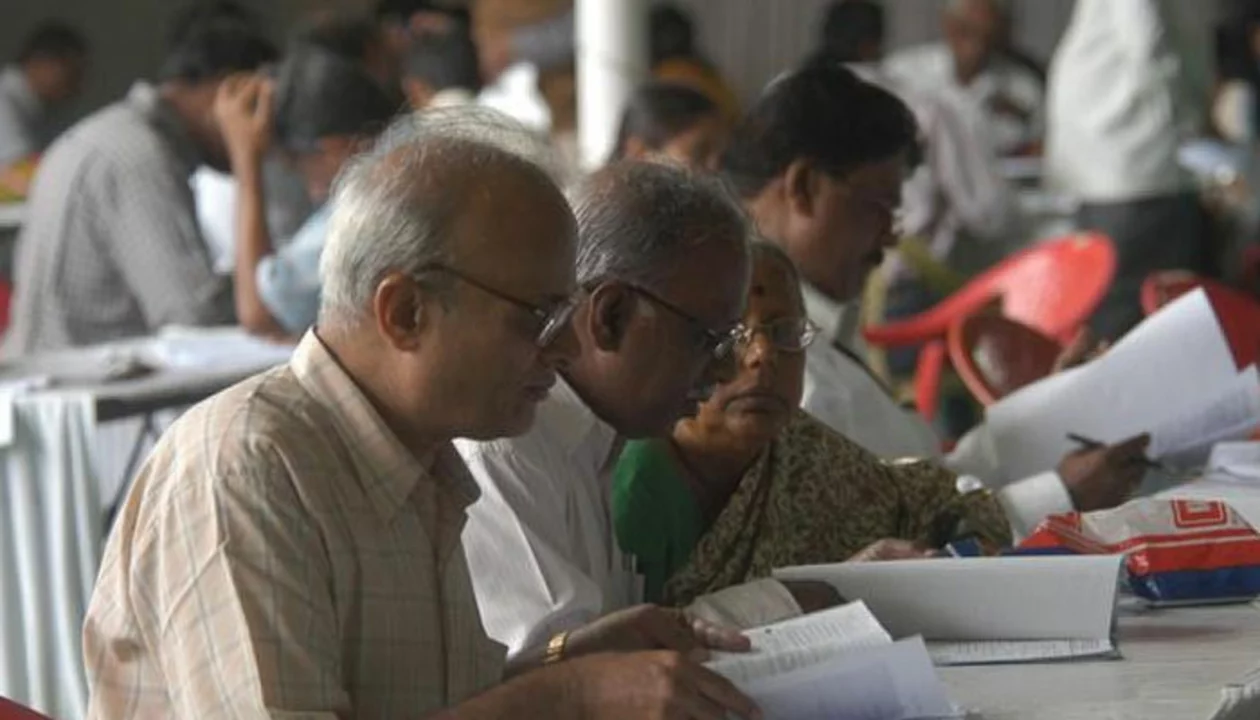

One thing many people struggle with is submitting documents online. Take the example of the SBI life certificate – a must for pensioners who need to prove they’re still alive to keep their payments flowing. The process is simple if you follow these steps:

- Download the Jeevan Pramaan app or go to the official website.

- Enter your Aadhaar number and pension account details.

- Verify the information and hit ‘submit.’

- The certificate is sent electronically to SBI, no branch visit required.

Doing it this way saves time, cuts travel costs, and reduces the hassle of standing in line. If you’re not comfortable with apps, the website version works just as well – just make sure you have a stable internet connection.

Everyday Money Management Hacks

Beyond specific tasks, good money habits keep your finances solid. Here are three habits you can start today:

- Track every expense. Use a free budgeting app or a simple spreadsheet. Seeing where each dollar goes helps you cut waste.

- Set up automatic transfers. Schedule a portion of your salary to move into a savings account each month. Automation removes the temptation to spend it.

- Review your bank statements monthly. Look for hidden fees, duplicate charges, or services you no longer need. Canceling a $5 monthly fee adds up fast.

These steps don’t require a finance degree – just a few minutes of attention each week.

What about emergencies? Keep a small “rainy‑day” fund in a separate account that’s easy to access but not tempting to dip into for daily purchases. Aim for at least one month’s essential expenses, then build toward three months.

If you prefer a digital‑first approach, most banks now offer instant alerts via SMS or email. Turn these on so you know the moment a transaction occurs. It’s a quick way to spot fraud or unauthorized spending.

Lastly, never underestimate the power of a quick phone call. If you notice a strange charge, call your bank’s support line before it turns into a bigger problem. Most issues are resolved in minutes.

Banking and finance don’t have to be a mystery. By mastering a few routine tasks like the SBI life certificate and adopting simple money‑management habits, you’ll stay in control of your finances and avoid unnecessary stress.

How to submit an online life certificate to SBI?

Submitting an online life certificate to SBI is a convenient way to ensure continued pension benefits. To begin, download the Jeevan Pramaan app or visit the official website to generate a digital life certificate. Next, provide your Aadhaar number, pension account number, and other required details. Once your details are verified, the life certificate will be sent to the bank electronically. This saves time and effort, allowing pensioners to avoid visiting the bank in person.

- May, 1 2023

- 0 Comments